Internationalized businesses are faster growing, more profitable and better able to create value and jobs than their domestically focused peers. In working with overseas clients, suppliers, financial organizations and other partners, these businesses often need to deal in foreign currencies, and they expose themselves to a certain degree of risk in the process. With the recent fluctuations in global currencies, currency risk is a concern for companies with customers, suppliers or production in other countries.

Over years, currencies vary significantly :

With the coronavirus health crisis in 2020, the past two years have seen dramatic fluctuations in currency exchange rates. Strict regulations to contain the epidemic have slowed the global economy, triggering a sharp change in exchange rates. The recent Russian war in Ukraine has brought even more uncertainty on international markets. Internationalized companies have been and will be strongly impacted by these situations which could have been anticipated and better managed by companies with the appropriate tools.

In this article we give you the keys to recognizing these risks and anticipating them.

What is currency exchange risk?

What do currencies such as Turkish lira, the Russian ruble, the Argentine peso and the South African rand have in common? In recent years, these currencies have seen the strongest fluctuations.

According to Investopedia “foreign exchange risk refers to the losses that an international financial transaction may incur due to currency fluctuations. It describes the possibility that an investment’s or payment value may decrease due to changes in the relative value of the involved currencies.”

If a firm’s local currency is strong, it can reduce the competitiveness of the firm’s exports abroad if the currencies of target countries are weaker. This reduced competitiveness can have the effect of increasing the country’s trade deficit, and eventually weaken the currency through a self-adjustment mechanism.

On the other hand, if a firm’s local currency is weak, its export competitiveness may be strong. Indeed, countries with stronger currencies will be tempted to import from countries with weaker currencies.

Currency exchange rates can impact merchandise trade, economic growth, capital flows, inflation and interest rates.

What is the impact of the exchange rate risk on companies?

Now that the concept of exchange rate risk is clear, in order to be well prepared, a company needs to know what kind of risks it could face dealing with foreign companies. Internationalized companies are exposed to three types of risks : transaction exposure, translation exposure, and economic or operating exposure.

Transaction exposure is the phenomenon that results from the effect of exchange rate fluctuations when converting from one currency to another to make or receive a payment. Essentially, the time delay between transaction and settlement is the source of transaction risk. This type of risk has a short or medium term impact. For example, a German company operating in China seeks to transfer 30 000,00 CNY in profits to its German account. If the exchange rate at the time of the transaction was 1 EUR for 6 CNY, and then the rate drops to 1 EUR for 7 CNY before settlement, the expected receipt would be 4 285,70 EUR (30 000,00 CNY/7) instead of 5 000,00 EUR (30 000,00 CNY/6). The company lost 715 EUR in only one transaction because of the fluctuation which shows how much exchange rate variation can impact a business’ margin.

Translation risk, also known as conversion exposure, is the risk that a company headquartered in the country but operating in a foreign jurisdiction, and whose financial performance is expressed in its home currency. Translation risk is higher when a company holds a larger portion of its assets, liabilities or shares in a foreign currency. This type of exposure is medium-term to long-term. For example, a parent company that reports in euros but oversees a subsidiary based in China faces a translation risk. This is because the subsidiary’s financial results – which are expressed in Chinese yuan – are converted into euros for reporting purposes.

Economic risk is the risk that the market value of a business will be impacted by fluctuations in exchange rates due to macroeconomic conditions. These macroeconomic conditions may be geopolitical instabilities and/or government regulations that may strengthen or weaken the local currency against those of competitors. For example, a Japanese furniture manufacturer that sells locally may face economic risk from Chinese furniture importers if the Yuan unexpectedly strengthens.

How to identify foreign exchange risk?

A business can use tools to identify exchange risks in advance in order to be better prepared for them.

The value-at-risk, or the VAR calculation is one of the most popular formulas in order to measure currency risk. The VAR helps to know the losses in the worst-case scenario.

A VAR statistic has three components: a time period, a confidence level and a loss amount (or loss percentage). This indicator gives the worst possible loss between 95% and 99% confidence in a given period. It allows companies to anticipate and prepare for the risk of loss.

Another method that can be used is the review of your business operating cycle to learn where exchange rate risk exists. The operating cycle is the time required for a company’s cash to be put into its operations and then returned to the company’s cash account. It is important to identify where the risks are in your operation as a company. This will help you determine your profit margin’s sensitivity to currency fluctuations. The operating cycle corresponds to :

the days’ sales in inventory (365 days/inventory turnover ratio) + the average collection period (365 days/accounts receivable turnover ratio)

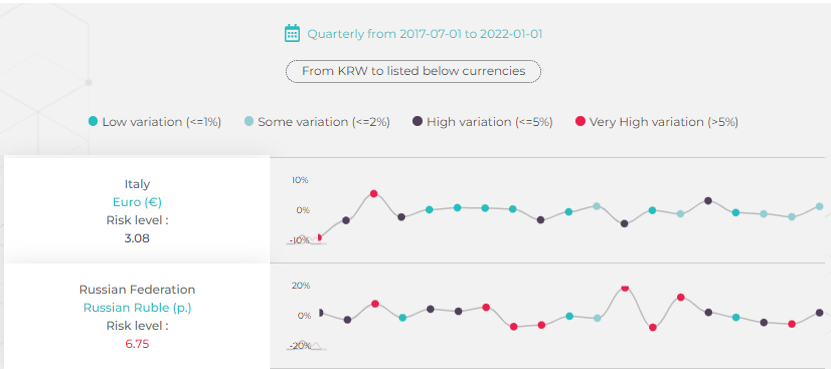

In order to have an idea of the level of foreign exchange risk, it is interesting to compare the variation in value between the currency of a company’s head office and that of the export target country over the medium term (shown below). Prime Target proposes you to integrate in your comparative market study its new indicator which compares your target countries according to the variation of their currency in the last 5 years as well as the level of currency risk.

In this example on the image below, it is a Brazilian company which hesitates to export between 5 countries: Mexico, Gabon, Italy, Vietnam and the United States. We were interested in the different currencies of the pre-selected countries. It appears that the United States represents the most risk with a risk level of 8.19 with a maximum decline of 23% between 2017 and 2022 and a rise of 13% in 2021 and a fluctuation of 22 points between April and July 2021. It is therefore advisable for the exporting company to consider putting in place for the United States a currency risks management solution.

Is exchange rate risk important when you select your international markets?

Choosing to internationalize one’s activity or to extend one’s international influence is key to gain market shares but also and especially, to increase one’s turnover. Before selecting target markets, it is important to take into account multiple indicators including country risk. The country’s risk can be defined by the perception of corruption or its economy but also by the risk of variations that its local currency represents. Indeed, as mentioned above, a country with a strong variation of its value represents a high risk for a company that would like to export or produce there. If the transactions are subject to strong fluctuations of the currency of the target country, the exporting company faces a lot of uncertainty and the risk of seeing its margin reduced or even reduced to nothing.

How can foreign exchange risks be decreased?

There are many ways to reduce currency risk. If you are a seller, the easiest way is to negotiate to be paid in your currency. The currency risk is then transferred to the buyer, but it is not always easy to obtain this type of contract.

It is also possible to share the risk by choosing a foreign currency for both the buyer and the seller or to make a payment in the seller’s currency and the other part in the buyer’s currency. If it is not possible to avoid transactions in a foreign currency, there are different ways to hedge against currency risk.

Transaction risk management tools:

Options

A currency option is a contract that gives a buyer, in this case a company, the right but not the obligation to buy or sell a currency at a predefined exchange rate. This transaction can be done until the option deadline. In order to have access to this type of contract, the company must pay a premium.

There are two types of currency options for managing risk. A “put” option gives the writer of the option the right to sell a specified number of units of foreign currency at a fixed dollar price. The other is what is called a “call” option, which allows you to buy the foreign currency at a set dollar price.

An option contract is the only solution that allows in addition to securing losses, to potentially make money. Indeed, the company can choose between the rate it has set with its option, or the current rate which may be more advantageous.

Money market hedges

This type of hedging works as follows: if a company knows that it will make a purchase in another currency in the future, it can purchase the value of the transaction amount in the required foreign currency at the current rate. This currency resource is stored in a bank account until the time of the transaction. With this method, the company secures its losses and earns interest. Businesses use this method for high and recurring transactions.

For example, if a company has a majority supplier in China, the company will create a yuan account in order to store in advance for its future supply needs.This type of contract is one the most common ways for companies to hedge against adverse exchange rate fluctuations as the company doesn’t need any intermediaries to execute that action.

Forward contracts

A forward contract is a good solution for a business to face transaction risks. A forward contract avoids fluctuations in the value of a transaction when a currency conversion is made in the future. Fluctuations are avoided by fixing the value of the exchange rate at the value it is on the day the deal is made as the one that will be taken into account at settlement. This type of contract allows you to predict and protect your cash flow by eliminating the uncertainties of an international deal and secures the value of the purchase for an importer, or the sale for an exporter. A forward contract is usually effective for a period of one year.

For example, a German company buys raw materials from its Chinese supplier with a payment term of 30 days after the order. It can decide to pay the amount at the predefined time assuming the value that the Yuan will have gained or lost against the Euro or decide to make a forward contract to ensure that the Euro does not lose value against the Yuan during the 30 day period.

Swap contracts (limit order)

Another solution to trading risk may be to set up a limit order. This type of contract sets the ideal exchange rate at which an importer would want to pay. This strategy is used when the exchange rates are momentarily unfavorable and when there are no limited payment terms.

For example, a German importer places an order with his English supplier but at that moment the exchange rate is 1EUR=0.87GBP. The importer may choose to place a limit order with his payment service provider targeting a rate of 1EUR=0.90GBP. When this rate is reached, the payment is made.

Translation and economic risks

It is impossible to eliminate translation and economic risks completely, but it is possible to reduce it through the implementation of a foreign exchange policy (see the image below). An effective foreign exchange policy begins with a clear understanding of the company’s financial objectives and the effect that exchange rate fluctuations may have on those objectives. For example, if operational cash inflows and outflows are in different currencies, the EBITDA objective may be compromised by changes in exchange rates when assets are revalued with new exchange rates. The currency risk management policy monitors and reduces currency risks.

Conclusion

In conclusion, there are 3 exchange rate risks that can impact your margins and your ability to predict your earnings: economic, transaction and translation risk. You can identify these risks by measuring them with formulas such as the “value at risk” or software such as Prime Target which integrates the level of risk and medium-term currency variations in its market selection study. These risks can be reduced or even avoided by using hedging contracts such as options, money market hedges, forward contracts, swap contracts or by setting up a foreign exchange policy.

How Prime Target can help you in your internationalization and currency exchange rate identification ?

Prime Target offers to assist companies in the selection of markets to target. Our solution is delivered in the form of a top 5 to 20 countries with fully customized recommendations. Click here to find out more