Businesses ranging from local firms to multinational companies suffered extensively due to the lockdowns in place during the pandemic. Simultaneously, the Covid-19 pandemic has caused significant disruption to international trade. As per UNCTAD, world merchandise trade recorded a decline of 7.4% in 2020 during the Covid-19 pandemic. Global exports amounted to USD 17.6 trillion, a USD 1.4 trillion fall from the previous year. This was the biggest annual decline since 2009, when trade fell by 22%. The decline in global services trade value was even stronger and it was the biggest decline in services trade since the beginning of its recording. In comparison, the value of trade in services fell by 9.5% in 2009 following the global financial crisis.

Trade impacts across specific goods, services and trade partners are highly diverse, creating pressures on some regions, specific sectors, and supply chains.

We have been witnessing an economic collapse which happens rapidly due to an unexpected event. As a result, the pandemic brought economic collapse in different regions which is a typical consequence of a time of crisis.

The industries most directly affected by the pandemic are those with jobs which are predominantly performed by small and medium enterprises. Moreover, they include such key activities as transport manufacturing, construction, wholesale and retail trade, air transport, accommodation and food services, real estate, professional services, and other personal services (arts, entertainment and recreation activities, hairdressing, etc.).

In this article we will see how the pandemic impacted different regions and countries, and will pay attention to regions and countries who were more resilient and regions and countries who suffered the most significant losses. In addition, our goal is to pinpoint the pandemic’s effect on the international trade cost and a specific attention will be paid to freight costs evolution during the crisis.

What was Covid-19’s impact on a regional level?

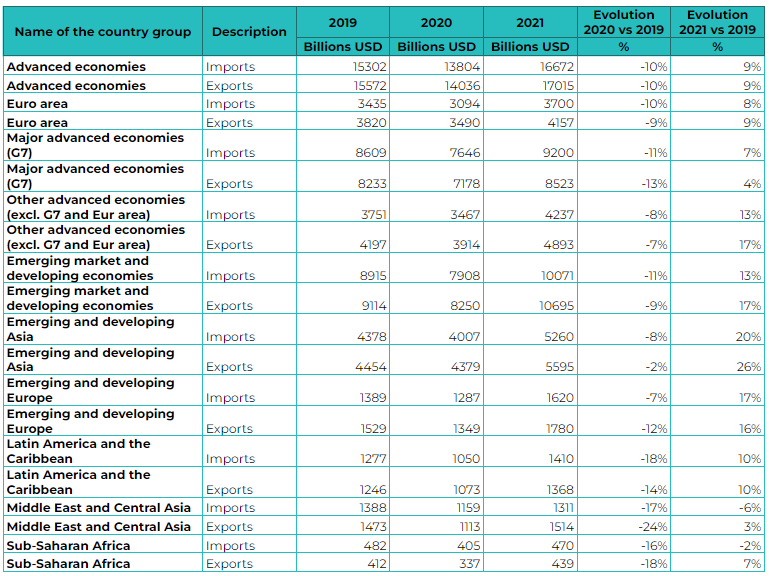

During 2020, most of the countries have suffered significant decline in their international trade compared to 2019 (see table below). However, by analyzing the impact on the regional level, we can notice that the impact is not evenly spread, and it ranges from 2 % to 24 % decrease for exports of goods and services and from 7 % to 18 % decrease for imports of goods and services.

For exports of goods and services, the hardest hit regions were firstly Middle East and Central Asia with 24 % decline compared to 2019 level, followed by Sub-Saharan African region with 18 % decline and Latin America and Caribbean region with 14 % drop.

The most resilient economies during the toughest year of Covid-19 pandemic economies were the countries in the Emerging and developing Asia region. This country group showed an insignificant 2% decline between 2020 and 2019.

For imports of goods and services, the same three regions suffered the largest shrinkage on global level with 18%, 17% and 16% respectively for Latin America and Caribbean region, Middle East and Central Asia and Sub-Saharan Africa.

The country groups with less impact for imports of goods and services are Emerging and developing Europe, Emerging and developing Asia and Other advanced economies (excluding G7 and euro area) with a weakening between 2020 and 2019 of 7%, 8% and 8% respectively.

The first observation can be drawn now regarding the regional disbalances and evident weaknesses during the economic crisis of Sub-Saharan African, Middle East and Central Asia and Latin America and Caribbean regions. Concurrently, our second observation is that Emerging and developing Asian nations have managed to navigate better during the pandemic and their economies have been impacted less.

Covid-19 impact on global imports and exports of goods and services, 2019-2021

Has global trade seen a recovery in 2021 on a regional level?

UNCTAD reported in February 2022 that all major trading economies saw imports and exports rise above pre-pandemic levels in the fourth quarter of 2021 and that global merchandise trade recovered fast. The report said “Overall, the value of global trade reached a record level of $28.5 trillion in 2021 and it is 13% higher compared to 2019, before the COVID-19 pandemic struck. “

Yet, the pace of growth gradually slowed over the course of 2021 and regions recovered indeed disproportionately.

Our table above provides data on a regional level, and it reflects the exports and imports performance of goods and services in 2021 compared to 2019. The evolution in value of imports and exports of goods and services for most regions undeniably have seen significant growth with Emerging and developing Asia leading with 26% and 20% for exports and imports respectively. The other leading regions are Emerging market and developing economies and Emerging and developing Europe. Regrettably, the recovery is nonetheless not at the level of 2019 for countries in regions of Middle East and Central Asia and of Sub-Saharan Africa.

Global trade: strong and shaky economies during the pandemic

Except, did really all the countries experience a decline in their international trade compared to 2019? To answer this question, we have decided to focus our analysis on exports of goods and compared more than 140 countries. Indeed, a healthy economy is one where both exports and imports are experiencing growth, nonetheless we have decided to focus on exports since first, exports boost economic output, second, they maintain and create jobs and wages and finally during crisis focusing on these factors is key for economies. The findings were quite interesting as the performance on a country-by-country level were certainly uneven.

Not surprisingly, we have found that in Asia, Vietnam and China witnessed an increase in their exports in 2020 compared to 2019 with 6 and 4 % respectively. In 2019, China represented 14% of the total export value among the 140 countries analyzed and Viet Nam – 1,5% of the total export value.

In Europe, Ireland and Latvia similarly saw a rise in their exports in 2020 compared to 2019 with 8 and 5 % respectively. Ireland represented 1% of the total export value among the 140 countries analyzed and Latvia is quite small – 0,1% of the total export value. Encouragingly, other countries in Europe saw little to no decline in their exports such as Switzerland and Poland.

Sadly however, there were many countries who suffered big losses in their international trade during the crisis. The most vulnerable economies for exports of goods during the pandemic were Kuwait, Qatar, Saudi Arabia, Nigeria, Colombia, and Russia with a decline of more than 20% of their exports of goods. Kuwait witnessed the sharpest decline of 38%.

Among developed economies, the countries with the sharpest decline for goods exports were Norway with 20% decrease, the United Kingdom with 16% decrease and the USA and Canada both with 13 % decline.

Trade costs and Covid-19

Due to demand variation, bottlenecks, volatilities, reduced shipping capacity, high uncertainty and possibly a hawkish behavior from transport companies, exporters had to deal with shipping rates moving to record highs.

For the latter, sea transport is moving more than 80 percent of the world’s traded goods and the impact of soaring costs for freight is significant. Some companies have been locked in tight contracts and rising trade costs made it difficult for companies to survive and project themselves in the future.

The transport costs have been seen by experts as the key determinant of variation of trade costs across sectors. As an example, the spot freight rates by major routes have seen annual increases varying 115% for a New York-Rotterdam route to 522% increase for Shanghai-Rotterdam route. The main increases were seen for the Asian region.

Global level of congestion in 2021

Forecasts for 2022

The Covid-19 management has improved on a global level, the number of cases decreased, despite some focal points still steering uncertainty. The UNCTAD expects international trade trends to normalize during 2022 though the trade growth in 2022 is likely to be lower than expected. The ongoing logistic disruptions and rising energy prices could affect global trade patterns during 2022.

On a positive note, regarding Covid-19, a recent report from McKinsey finds that the outlook for most regions remains relatively favorable with levels of severe disease at or below recent levels which allows us to stay rather optimistic for the future of global trade.

How Prime Target can help you with your internationalization and identification of potential markets:

Prime Target offers to assist companies in the selection of markets to target. Our solution is delivered in the form of a top 5 to 20 countries with fully customized recommendations. Click here to find out more