Many companies decide quite early to make their first sale abroad, a certain source of growth and opportunity. However, when addressing international markets, companies struggle to understand and estimate the time and the costs of international market access. As per WTO’s definition, market access is an umbrella term for a number of measures that a country may use to restrict imports. And indeed, the most common and known form of such restrictions are tariffs on imported goods.

However, the current trends show that non-tariff barriers are becoming more and more complex to understand and to comply with. Thus, understanding international market market access plays an important part in guiding a business’s future growth. When seeking to expand internationally, evaluating market access is a crucial step to develop an international strategy for a company. This evaluation can even guide a business in adaptation of its products and services.

Customs duties

Customs duties are a tax imposed on imports by a country’s customs authority, for example as a percentage of value or at a specific rate. The main effect of customs duties is that of raising the price of the product sold abroad to protect the products and services related to the same type of products in the importing country from competition. Indeed, customs duties can have a direct impact on your exports and your access to new markets. If you use a pricing strategy to differentiate yourself from your competitors, it may no longer be valid abroad.

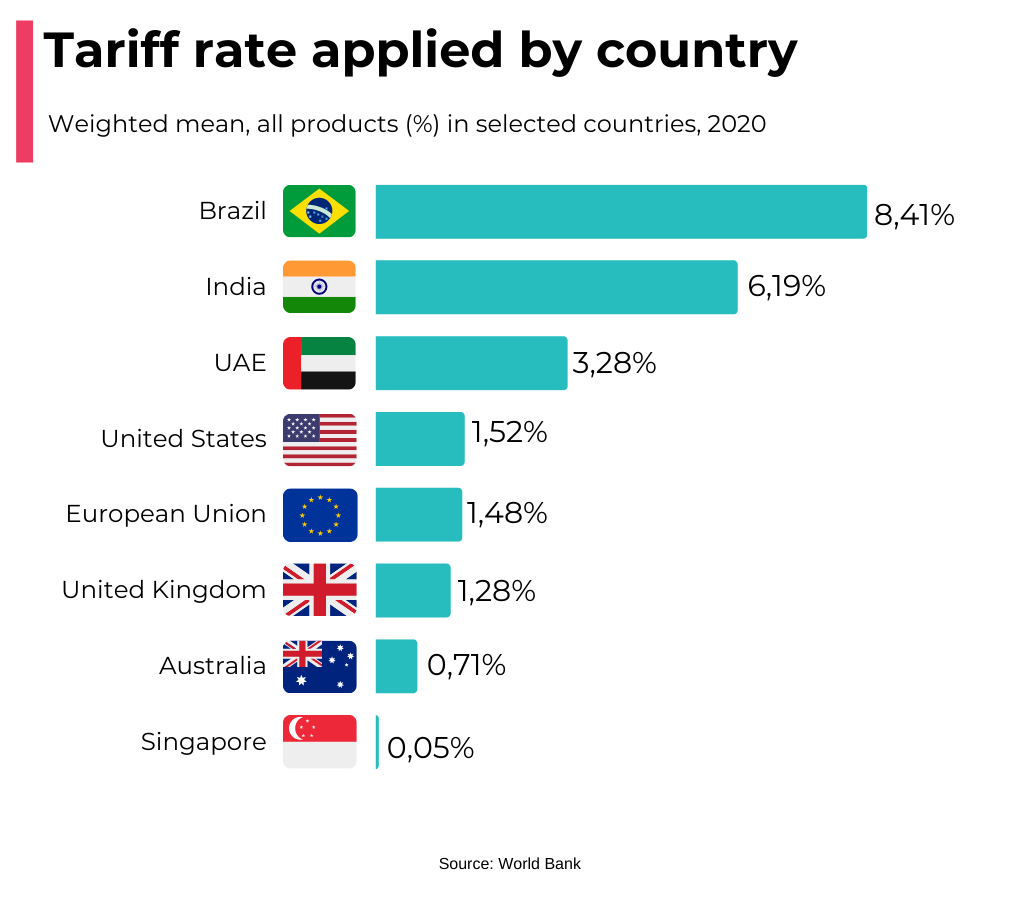

Because of customs duties, your product may sell for much more abroad than in your home market. For example, highly protectionist countries like Brazil and India, can impose 30 to 80% customs duties, compared to the USA, Europe, Australia or the United Kingdom where the average costumes duties applied are much lower. You will need to find other ways to differentiate yourself from your competitors and perhaps select countries with few tariffs and/or competitors.

Determining customs duties

Each product has a specific duty rate, which is determined by a number of factors, including where you sell your products, where it was made, and what it is made of. In order to determine the “What it is made”, you have to define to which category your product belongs, and for that there is an international nomenclature, the HS code.

HS stands for Harmonised System and is an international nomenclature developed by the World Customs Organisation (arranged in six-digit codes), allowing all participating countries to classify traded goods on a common basis. Hence, up to the HS-6 digit level, all countries using the Harmonised System classify products in the same way. To find the HS code specific to your products, we invite you to browse the European Customs Portal.

The second thing to determine is the country of origin of the product to answer the question “Where it was made”. When the goods are produced entirely in one country, determining the country of origin is relatively simple. This is the case, for example, with agricultural or horticultural products. On the other hand, when the raw materials or component parts needed to manufacture the product originate in different countries, this can cause difficulty in determining the country of origin of the finished product. In order to determine the origin of a product, it is necessary to look at where the last processing took place and its importance in the manufacturing process. For this purpose, the last processing “must be economically justified, carried out in a company equipped for this purpose and have resulted in the manufacture of a new product or represent an important stage of manufacture”.

When you have all these elements, in order to calculate the customs duties, you just have to go to the International Trade Center website and go to the Market Access Map which allows to identify general, MFN and preferential tariffs applied by an importing country to its partners, by product and by year.

Competition Intensity

Although the presence of a competitor indicates the presence of a demand for your products in the market, it also hinders your access to the market. If a particular industry has a very high number of firms offering identical products to yours, this will lead to more competitive intensity and a difficult access to the market. However, in an oligopoly market structure that is dominated by just one or a few firms. There will be less rivalry but the size of these players can be a hindrance to gaining market share. International competitors can also have a strategy or behavior in order to increase barriers to entry.

This type of barrier refers to the strategies of established firms to preserve their market shares by deterring entry. This may involve patents which become real barriers to entry. Firms may also foreclose by restricting access to an essential resource, thereby blocking entry. There are also long-term contracts that can limit the migration of consumers to competitors, thus reducing the profitability of entry, for example telecoms and energy contracts.

To access the market despite the presence of competitors, it is necessary for your company to identify and analyze them. This knowledge of the competition allows you to identify their strategies, number, concentration and to adapt your market entry strategy.

Member of the same trade agreement

Trade agreements make it easier and cheaper to export, giving your product a competitive edge in the destination market. Tariff liberalization was initially pursued through trade agreements under the World Trade Organization (WTO). The World Trade Organization is the only international organization dealing with the global rules of trade. Its main function is to ensure that trade flows as smoothly, predictably and freely as possible. By lowering trade barriers through negotiations among member governments, the WTO’s system also breaks down other barriers between peoples and trading economies.

The number of preferential trade agreements in the recent past has been impressive. At the launch of WTO in 1994, only 37 agreements were in place. By 2021, 355 regional trade agreements were in force.

Some regional trade agreements are known worldwide, such as the European Economic Area (EEA). The EEA includes EU countries and also Iceland, Liechtenstein and Norway. It allows them to be part of the EU’s single market. Switzerland is not an EU or EEA member but is part of the single market.

The same applies to the North American Free Trade Agreement (NAFTA), which was enacted in 1994. It created a free trade zone for Mexico, Canada, and the United States. This is the most important feature in the U.S. – Mexico bilateral commercial relationship.

Infrastructure development

Infrastructure development can contribute to growth and development in several ways. Various types of infrastructure can be provided to promote international trade. Trade related infrastructure includes ports, airports, roads and railways. They are crucial in linking a country to the outside world. Intangible infrastructure is less visible but equally important for trade, such as border administration and logistics. The lack of infrastructure in a country will make it difficult for you to export. If there is no local transport network, you will not be able to reach your customers. The same applies to production, you will find it difficult to produce if there are frequent power cuts. In fact, it is in the poor countries that this lack of infrastructure is most important. There is a lack of funding in theses countries for infrastructure development.

The Logistics Performance Index is an interactive benchmarking tool created by the World Bank, a good indicator for comparing the logistics performance of different countries around the world. The overall score reflects perceptions of a country’s logistics based on efficiency of customs clearance process, quality of trade and transport-related infrastructure. And also ease of arranging competitively priced shipments, quality of logistics services, ability to track and trace consignments, and frequency with which shipments reach the consignee within the scheduled time.

Government regulations & procedures

Procedures to register a business

Procedures are those required to start a business, including interactions to obtain necessary permits and licenses. Also interactions to complete all inscriptions, verifications, and notifications to start operations. Some countries require an important amount of documentation to register a new company in their territory. These formalities risk delaying your establishment and jeopardizing the investments you have made to develop your business abroad. The world bank provides an indicator called : Start-up procedures to register a business. Use this tool to find out the average number of procedures per country required to register your company abroad.

Requirements of government regulations or non-tariff barriers

A registered company is a legal entity in itself, and required to follow the corporate laws of that country. Often the laws tend to be complex with regards to corporate entities. The number of government regulations will slow down your development abroad and act as a barrier to entry in some cases. You also have to take into account the time that is spent dealing with the requirements imposed by government regulations. These regulations can be taxes, customs, labor regulations, licensing and registration, including dealings with officials, and completing forms.

Most products must meet technical or health and hygiene requirements in your export market. Depending on the country, you may have to undergo tests to obtain the necessary certificates to export your products. This is often the case for technical requirements applicable to industrial products, as well as health and hygiene requirements applicable to food stuffs and agricultural products.

If your products do not comply with these regulations, market access may be limited or impossible. The only solution is to make your products compliant with the regulations, which sometimes requires significant investment.

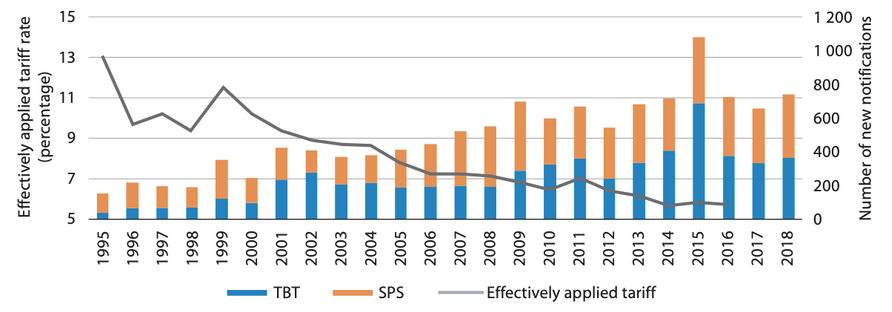

A vast number of companies analyze mainly the customs tariffs and underestimate the non-tariff regulations. Such as customs procedures, labor regulations, licensing and registration, sanitary and phytosanitary (SPS) and TBT (technical barriers to trade) measures etc. However, it has been estimated that the trade costs of non-tariff barriers are more than double that of ordinary customs tariffs. (see image below).

Average applied tariffs and annual new notifications to WTO of SPS and TBT measures in the Asia-Pacific region

Intellectual property

Whether you intend to export, produce abroad or work with foreign partners, you may find yourself in markets where your intellectual property rights are not protected. By securing intellectual property rights in these markets, you will prevent third parties in those markets from exploiting your intellectual property rights, which will encourage them to work with you under a licensing or similar arrangement.

Beware that patents already registered by local companies may constitute barriers to entry, making access to the market impossible. If a patent exists, you need to carry out research to get round it. The World Intellectual Property Organization database gives you access to all patents.

Invisible entry barriers

Informational Barriers

Lack of access to information is a major issue in informational barriers to entry in a market. Indeed, not all countries provide access to the same quantity and diversity of data. And when you don’t have any access to information you increase the level of uncertainty of foreign markets. It’s the same issue with problems associated with the source, quality, and comparability of available data used to attempt to increase understanding of foreign markets. Unavailable or poor quality information reduces your preparation before entering the market. Such as identifying potential customers, contacts, business partners or joint ventures.

Cultural differences

Lot of companies breaking into the international market underestimate the barrier posed by cultural differences. Expansion planning requires an in-depth knowledge of cultural differences as consumer preferences and current purchase behavior. Language and cultural barriers present considerable challenges, as well as institutional differences among countries.

To cope with these differences, you may have to adapt your products to gain access to the market. These cultural differences are highly visible in food companies. To access new markets, they must constantly adapt to cultural differences. McDonald’s, after realizing that Chinese consumers preferred chicken to beef, modified its recipes and now offers a wider range of chicken-based burgers.

Key Takeaway

Market access refers to the ability of a company to sell goods and services across borders. The ability to sell in a market is often accompanied by customs duties, or even quotas, whereas free trade implies that goods and services flow across borders without any extra costs imposed by governments. In addition, other factors can slow down your access to the market, such as competition intensity, infrastructure development, government regulations or even cultural differences. Our key take-away from this article is preparation is key, especially before exporting to countries with high market access barriers.

Prime Target can accompany you in your international business project, and assist you in market potential evaluation. Prime Target’s Market Ranking Report can help you evaluate the market potential of 5, 10 or 20 countries simultaneously, and identify new export markets with the highest potential. This comprehensive and personalized Market Ranking Report can minimize risk, saving time and money, as well as identify new business opportunities abroad.