The global stage has been grappling with an inflationary crisis, reaching its zenith in late 2022. This abrupt surge in inflation can be attributed, in part, to various shocks, including the war in Ukraine and the Covid-19 outbreak, alongside the escalation in energy prices and raw materials costs. According to the International Monetary Fund (IMF), the worldwide inflation rate climbed to 8.7% in 2022 and shows no immediate signs of reverting to a “normal“ state. While a modest level of inflation can offer certain benefits to an economy, a persistent and continual high inflation carries adverse consequences. For instance, prior to the concerning inflationary episode of 2022, the European Central Bank (ECB) and the Federal Reserve (FED) had been adhering to a policy aimed at maintaining a 2% inflation rate—a benchmark deemed conducive to upholding consumer price stability while also fostering economic expansion.

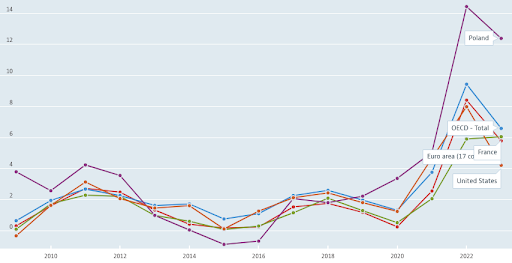

Inflation measures the general evolution of prices. It is defined by OECD as the change in the prices of a basket of goods and services that are typically purchased by households. We can notice from the charts below that inflation forecast varies from country to country and at the OECD level, the average inflation in 2023 is expected to be 6,6%, whereas in the USA, it is forecasted at 4,2% level, in France – at 6,1 % and in Poland – at 12,4%.

Inflation forecast 2010 – 2023

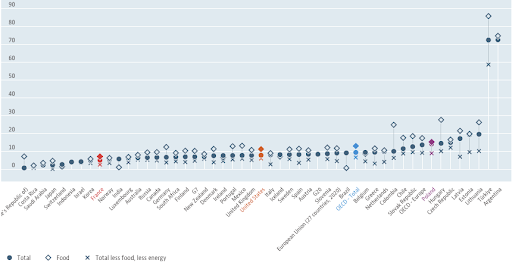

In terms of 2023 inflation current rates, among the OECD countries, Turkey and Argentina are the most impacted by the CPI(consumer price index) rise with inflation rates exceeding 50 % (see graph below.)

Inflation (CPI) in 2023

In this situation, every business involved with operations in international markets has to cope with a lot of uncertainties. But moreover, this inflation is taking a toll on international trade and reshaping the world supply chain. If your business is involved in international trade, you might ask yourself: how will inflation impact my exports ?

In this article, we will cover all the effects inflation can have on your business as well as some tips to overcome the situation.

The different effects of inflation on your company

Increased costs

When inflation occurs following an increase of raw materials prices, we are talking about a “cost-push” inflation. In this context, companies tend to increase their prices and therefore, it leads to a vicious cycle in which inflation is sustaining itself. This general inflation generates a decrease in the purchasing power of consumers, and therefore can lead to higher wages. Your labor costs will go up accordingly.

Depending on the situation of your company and the business area you’re operating in, inflation will most likely increase the price of your inputs and all of your expenses in general. All of your costs can escalate quickly in a nation wide inflation context such as your inventory costs, your transport costs and even your rents if it applies to your situation.

Reduced margin

Subsequently, the increase in your company costs will leave your margin reduced. If you have the negotiating power to do so, you can pass on the increase of your expenses into your prices. In the case of you already have low margins or if you can’t raise your prices according to the decrease of your margins due to your low negotiating power, this can lead to a financially complicated situation for your company.

If you increase your prices, the risk is to lose competitiveness and therefore, customers. In case of inflation, customers adopt a wait-and-see attitude and can redirect part of their budget to more essential goods. If you sell a low price elasticity good, you won’t be as impacted as a company selling non-essential items

Positive effects

Inflation episode isn’t always something to fear for your business. As we said earlier, it’s even the goal of most governments to reach a 2% inflation goal for their economies to thrive. It can be beneficial, even more so if you export internationally.

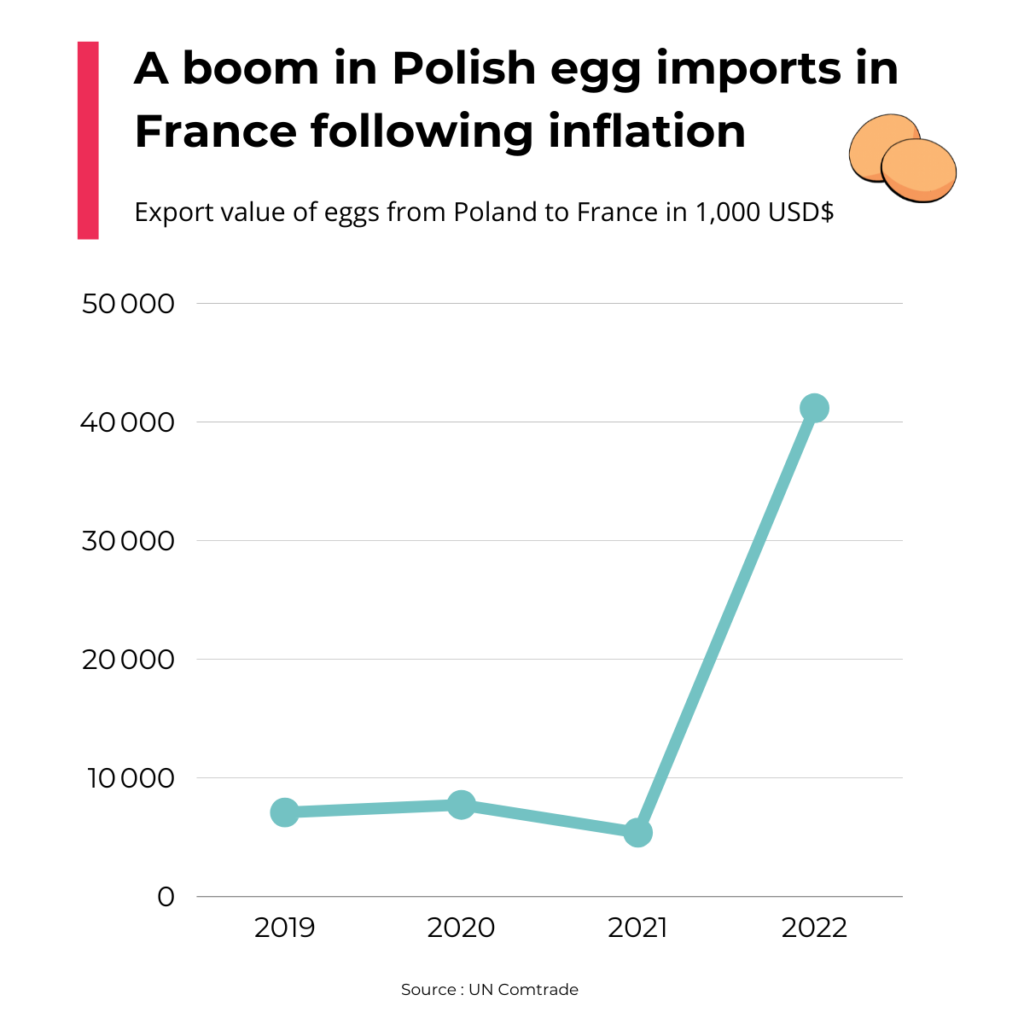

When inflation surges in the target nation for your exports, it triggers a subsequent rise in your competitors’ prices. As a result, consumers are more inclined to shift towards your goods, which become more attractively priced compared to those of competitors operating within that country. Consequently, your competitiveness experiences an upswing. For instance, there was a significant price hike in eggs in 2022 in France that reached 31%, particularly for those destined for the food industry. This situation prompted a substantial surge in imports from Spain and Poland. Despite being a staple expenditure, the demand for eggs in France remained relatively stable among consumers. According to France’s prominent business newspaper, Les Echos, Poland outpaced Spain as the primary egg exporter to France in 2022, with respective imports of 14,600 and 14,200 tons.

In summation, Polish and Spanish eggs gained a notable edge in price competitiveness compared to their French counterparts due to the prevailing inflationary environment in France. The accompanying graph illustrates the pronounced increase in Polish egg imports to France during 2022.

Some tips to manage inflation for your business

Having elucidated the adverse effects of inflation, do take comfort in the fact that we are now poised to present you with hopefully valuable insights to enhance your resilience in the face of this predicament.

Adjusting your price policy

For your export destinations as well as your domestic market, rising your prices is practically inevitable during an inflation period to pass on the production costs. However, you must do so strategically. According to the British Business Bank, if you want to raise your prices, you better apply one big rise and communicate with your clients in that sense, than to gradually raise your prices. Numerous pricing strategies are at your disposal, provided you exercise the necessary bargaining influence. Striking a balance is crucial; overpricing might lead to customer attrition, while underpricing could stifle your company’s profit margins. Vigilant observation of competitors’ pricing and market dynamics, coupled with adept adjustments to your pricing strategy, is imperative. Above all, diligent monitoring of your profit margins and rival price points takes precedence.

Product mix

One of the business decisions you can make for your company to thrive during inflation times is to modify your product mix. A lot of combinations can be efficient, again, depending on your situation. For instance, you can minimize the impact inflation has on your company by diversifying the goods you commercialize. Some business areas are more impacted than others by inflation. The more you diversify your product mix, the less sensitive your company will be to economic difficulties. You can also remove products from your catalogue to only focus on your best-selling products.

Reorganize your supply chain

Depending on only one or few suppliers can be a threat for your exports. If inflation is rising, you won’t have much negotiating power in such a position. It has its importance, especially when the inflation is caused by the rise of raw materials and energy prices. According to a study from EY conducted in 2022, 62% of companies reported a change in their supplier base during the past two years, partly due to the increase of input prices and labor costs. It means that companies reorganized their supply chain to be less sensitive to external shocks, such as inflation for example. Diversification in your suppliers helps your company to control or cut costs. You will gain negotiating power and therefore be more resilient towards inflation and manage your export operations better.

Optimize your cost structure

Monitoring all your business expenses is important in times of inflation to limit your costs to the essential ones, especially if you are not in a position to raise your prices significantly. You can also reduce some of your essential costs by negotiating with suppliers, as far as possible. It can help you avoid raising your prices and therefore lose customers. As reported by Reuters, the fashion retailer H&M is using this technique to cope with inflation.

The company put in place a big savings program where the non-essential costs are being cut like business trips, tech services and also lower the rent of their shops and offices. Even if other variables come into play, this program played a role in the fact that for the first semester of 2023, the fashion brand surprisingly registered a profit of 725 million Swedish crowns against 458 million crowns in 2022 for the same period. Mastering their costs helped the company overcome inflation globally.

Brand image and positioning

Amidst a challenging phase of inflation, repositioning holds the potential to be a vital survival strategy. It enables you to provide a more coherent justification for cost increases while minimizing customer attrition and simultaneously bolstering profit margins. Repositioning offers benefits beyond inflation adaptation—it could facilitate business expansion and advancement. As reported by Forbes, this is the decision the mid-luxury fashion brand Coach took in late 2022. Described before as an “affordable” luxury brand, they are now taking a turn and presenting Coach as an “expressive and modern” luxury brand, focusing on the product quality and sustainability. Along with the repositioning, came a rise in their prices. With this strategy, Tapestry, the mother company of Coach, is hoping to capture the Gen Z consumer segment. They target a revenue of 5,7 Billion USD($) for 2025.

One mistake to avoid is underinvesting in marketing and communication during a crisis. It is precisely the right time to invest in brand image and communication, as your prices are rising and as the purchasing power of your customers is going down. Primarily, effective communication is essential when implementing price increases to maintain your customer base. Additionally, during inflationary periods, it becomes imperative to enhance and fortify your brand image to uphold your consumer relationships. By consistently investing in your brand identity, you increase the likelihood of customer loyalty, even for non-essential products.

Key takeaways

In summary, inflation can manifest in diverse ways, encompassing cost escalation and supply chain disturbances. To navigate this period with utmost resilience, diversifying your product range and supplier network is vital. Interestingly, inflation can occasionally bolster your competitive edge, proving advantageous for your company. It’s important to acknowledge the subjective nature of inflation’s impact on each situation. The effects of inflation and the strategies we’ve discussed may not universally apply. Variables such as inflation levels, industry sector, country, target consumers, and product offerings play pivotal roles. Nonetheless, the key is to diligently monitor your company’s circumstances and proactively take measures to enhance resilience, ensuring your business stays afloat.

Prime Target can accompany you in your international business project, and assist you in market potential evaluation. Prime Target’s Market Ranking Report can help you evaluate the market potential of 5, 10 or 20 countries simultaneously, and identify new export markets with the highest potential. This comprehensive and personalized Market Ranking Report can minimize risk, saving time and money, as well as identify new business opportunities abroad.